Get Connected

HSA

1-866-234-8913

Visit Website

Download the mobile app!

Video: Optum Bank Mobile App

Manage account, view your balance, check qualified expenses, file a claim and more – online!

Learn More

HSA

- Video: What is an HSA?

- Video: How to use an HSA

- Video: Investing with an HSA (Standard)

- Video: Investing with an HSA (without Betterment)

- Video: Tax time and an HSA

- Video: The 5 Stages of Health Saving and Spending

- Video: Optum Bank Mobile App

- PDF: HSA and Medicare

FAQ

Can I change my HSA contribution?

Yes. Fill out this HSA Change Form and follow the directions at the bottom to submit

Documents

Health Savings Account

OptumBank

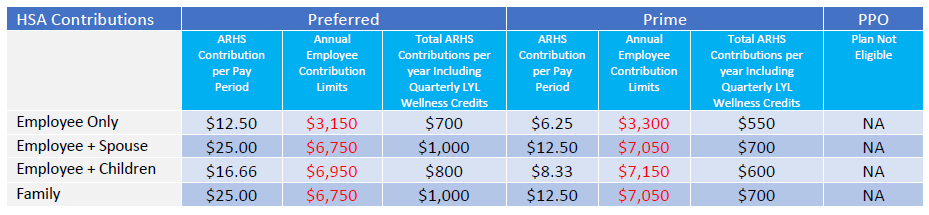

Each pay period ARHS will fund a savings account for you that can be used to pay for qualified medical expenses not covered under your health insurance benefits. You are also encouraged to add to your HSA with regular payroll deductions. The money you save to your HSA is tax-free and rolls over each year. See the chart below for the amount ARHS deposits into your HSA account annually, and the amount that you are able to contribute to reach the maximum dollar amount allowable by the IRS in 2023.

2023 IRS Limits – Total Contributions: Individual – $3,850 Family – $7,750 / **See Employee contribution limits below in red

You are not eligible for an HSA if any of these criteria apply:

- Your spouse has a Flexible Spending Account that can be used for your medical expenses.

- Participation in any type of Medicare, Tricare or Tricare for life, makes you ineligible to contribute to an HSA.

- You are claimed as a dependent on someone else’s tax return.

- You are not enrolled in the CDHP (Consumer Driven Health Plan).

*Age 55 and older may make an additional annual $1,000 catch-up contribution to your HSA.

*Remaining balance in your HSA at the end of the year rolls over to the next plan year.

*The use of HSA funds for non-qualified purposes is subject to income tax.

What is Love Your Life (LYL)? Learn more about the program and earning HSA contribution incentives >

NOTE: While the Affordable Care Act allows parents to add their adult children (up to age 26) to their health plans, the IRS has not changed its definition of a dependent for health savings accounts. This means that an employee whose child aged 24-26 covered on his/her HSA-qualified health plan cannot use HSA funds to pay that child’s medical bills.

MEDICARE: Will you be turning 65 soon? If you have an HSA it is important to plan ahead and understand how enrolling in Medicare will affect your HSA. By enrolling in any type of Medicare (Parts A, B, C-Medicare Advantage, D, or Medicare Supplemental Insurance-Medigap), you can no longer contribute to your HSA. The month you enroll in Medicare, all contributions to your HSA must stop.